For many Indian businesses, earning foreign currency signifies growth, but cross-border transactions often tell a different story. Invoices can take days to clear, may incur unexpected deductions, and may require additional documentation. The gap between billed and received amounts drains profits.

This frustration intensifies with monthly recurring issues, such as unpredictable settlements, hidden conversion spreads, and proof-of-remittance chases, which slow cash flow and complicate compliance, hindering confident scaling.

But this doesn’t have to be your reality. Advances in Global Transaction Processing now make it possible to reduce these leakages, gain visibility, and bring consistency to international transaction flows.

In this blog, we’ll explore the latest trends shaping international transactions, practical steps you can take to protect your revenue, and a checklist to evaluate the right payment partner for your business.

Why international transaction matters for you

If you’re dealing with clients or customers abroad, every international transaction carries both opportunities and risks. On one hand, you gain access to new revenue streams and global markets. On the other, you encounter hidden costs, delays, and compliance paperwork.

Some of the most common challenges include:

- Hidden FX markups: Banks and intermediaries often add extra margins beyond the mid-market exchange rate, reducing the final amount received.

- Intermediary bank deductions: SWIFT transfers often pass through multiple banks, each of which charges fees.

- Settlement delays: Depending on routing, funds may take several days to reach your Indian account.

- Compliance requirements: Documents such as the FIRC (Foreign Inward Remittance Certificate) or FIRA are necessary for export claims, GST refunds, and audits.

Even small differences accumulate. For instance, a freelancer charging $2,000 per project might lose $60–$80 per transfer due to hidden costs. A larger exporter moving $200,000 could face losses in the thousands. Over time, these costs diminish competitiveness.

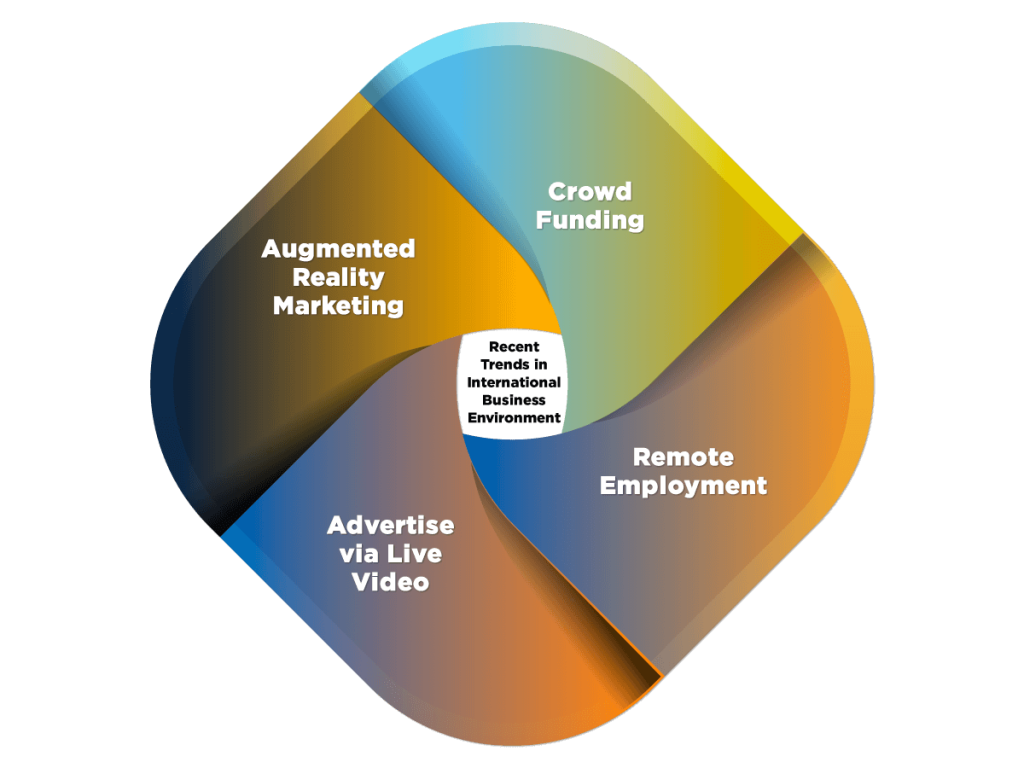

Key trends shaping international transactions

Global payment systems are evolving quickly, and Indian businesses can benefit from these shifts:

1. Rise of multi-currency accounts

Many payment providers now allow you to collect payments in local currencies, such as USD, GBP, EUR, CAD, or AUD. This avoids unnecessary conversions and correspondent bank deductions. Instead of multiple middlemen, the flow is simplified, saving both money and time.

2. Faster compliance reporting

Where businesses earlier had to wait weeks to receive FIRC/FIRA, many providers now issue downloadable settlement certificates instantly. This not only reduces administrative hassle but also speeds up access to export-related incentives.

3. Growth of subscription and recurring billing

Indian SaaS platforms, consultants, and service providers are increasingly billing clients on a recurring basis. Using recurring payment flows and APIs guarantees steady cash flow, higher approval rates, and less manual work.

4. Smarter payment routing

Intelligent orchestration engines are being used to route transactions through the best channels. This boosts approval rates, cuts declines, and lowers costs. For businesses processing hundreds of payments each month, these savings are substantial.

5. Customer expectation of faster settlements

Global buyers expect smooth experiences. A failed or delayed transaction can impact your brand. Having reliable systems with high uptime and consistent approval rates builds trust.

Practical playbook for Indian businesses

To make international payments work in your favor, here are the steps you can apply:

- Switch to local collection accounts in key markets to avoid multiple intermediary charges.

- Track gross vs. net receipts regularly to identify costly payment routes.

- Negotiate or compare FX margins across providers to ensure you get rates close to the market average.

- Insist on automated FIRC/FIRA delivery for every inward remittance to simplify tax and incentive claims.

- For subscriptions, use card-on-file billing with proper consent and retry logic to reduce payment failures.

- Invoice with buffers for fees on smaller ticket items to ensure you receive the intended net amount.

- Automate reconciliation by mapping incoming remittances to invoices in your accounting software.

- Leverage foreign balances strategically, holding them temporarily when exchange rates are favorable.

- Monitor approval rates by region and adjust payment routing to minimize declines.

- Utilize APIs or no-code plugins for faster integration, rather than relying solely on manual bank processes.

By implementing even two or three of these actions, you can reduce costs by several percentage points and reclaim revenue that would otherwise be lost.

How to pick the right payment partner

Selecting a payment partner is not just about fees; it’s about striking a balance between cost, compliance, and scalability. Use this checklist to guide your choice:

- Local collection options: Does the provider offer accounts in the currencies of your target markets?

- Transparent fees: Are FX margins, platform charges, and correspondent deductions clearly stated?

- Compliance support: Do they issue FIRC/FIRA instantly and provide downloadable settlement reports?

- Integration flexibility: Can they integrate with your website, app, or ERP through APIs or plugins?

- Recurring payment capability: Do they support standing instructions and subscription models?

- Settlement speed: How quickly can they move money to your Indian account?

- Uptime and reliability: Do they consistently deliver high approval rates and 100% uptime?

- Customer support: Is there responsive support for failed transactions or compliance queries?

Why compliance documents matter for you

When money comes into India, it’s not just about receiving funds; it’s about having legal proof. FIRC or FIRA, issued by banks or payment providers, act as evidence of foreign remittance. Without these, you may struggle with GST refund claims, export incentives, or future audits.

- Freelancers can use FIRC/FIRA to show legitimate income from overseas clients.

- Exporters need these documents for DGFT schemes and to claim duty drawback or MEIS benefits.

- Enterprises often use them to streamline audits and meet RBI reporting requirements.

Having instant access to these documents prevents compliance stress and helps you stay on the right side of regulations while expanding globally.

Conclusion

International payments no longer need to be unpredictable or overly complex. By utilizing modern payment solutions, establishing multi-currency accounts, and requiring transparent documentation, Indian businesses can minimize friction and safeguard their margins.

The development of international transaction systems is moving toward greater transparency, speed, and reliability. By staying informed and choosing the right partner, you can turn what was once a challenge into a growth advantage.